What Is The Pennsylvania Estate Tax Exemption . This means that with the right. In general, any items the decedent owned solely, jointly or in trust are taxable unless specifically excluded from taxation by law. the pennsylvania tax applies regardless of the size of the estate. property owned jointly between spouses is exempt from inheritance tax. the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. 15% on transfers to other heirs, except charitable organizations, exempt institutions, and government entities exempt. Effective for estates of decedents dying after june 30,. the family exemption is allowable against assets which are part of the decedent's probate estate. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. There are, however, ways to reduce pennsylvania’s inheritance tax. Estates and trusts are entitled to deduct from their income any.

from www.exemptform.com

There are, however, ways to reduce pennsylvania’s inheritance tax. the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. the family exemption is allowable against assets which are part of the decedent's probate estate. property owned jointly between spouses is exempt from inheritance tax. Effective for estates of decedents dying after june 30,. This means that with the right. 15% on transfers to other heirs, except charitable organizations, exempt institutions, and government entities exempt. In general, any items the decedent owned solely, jointly or in trust are taxable unless specifically excluded from taxation by law. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. Estates and trusts are entitled to deduct from their income any.

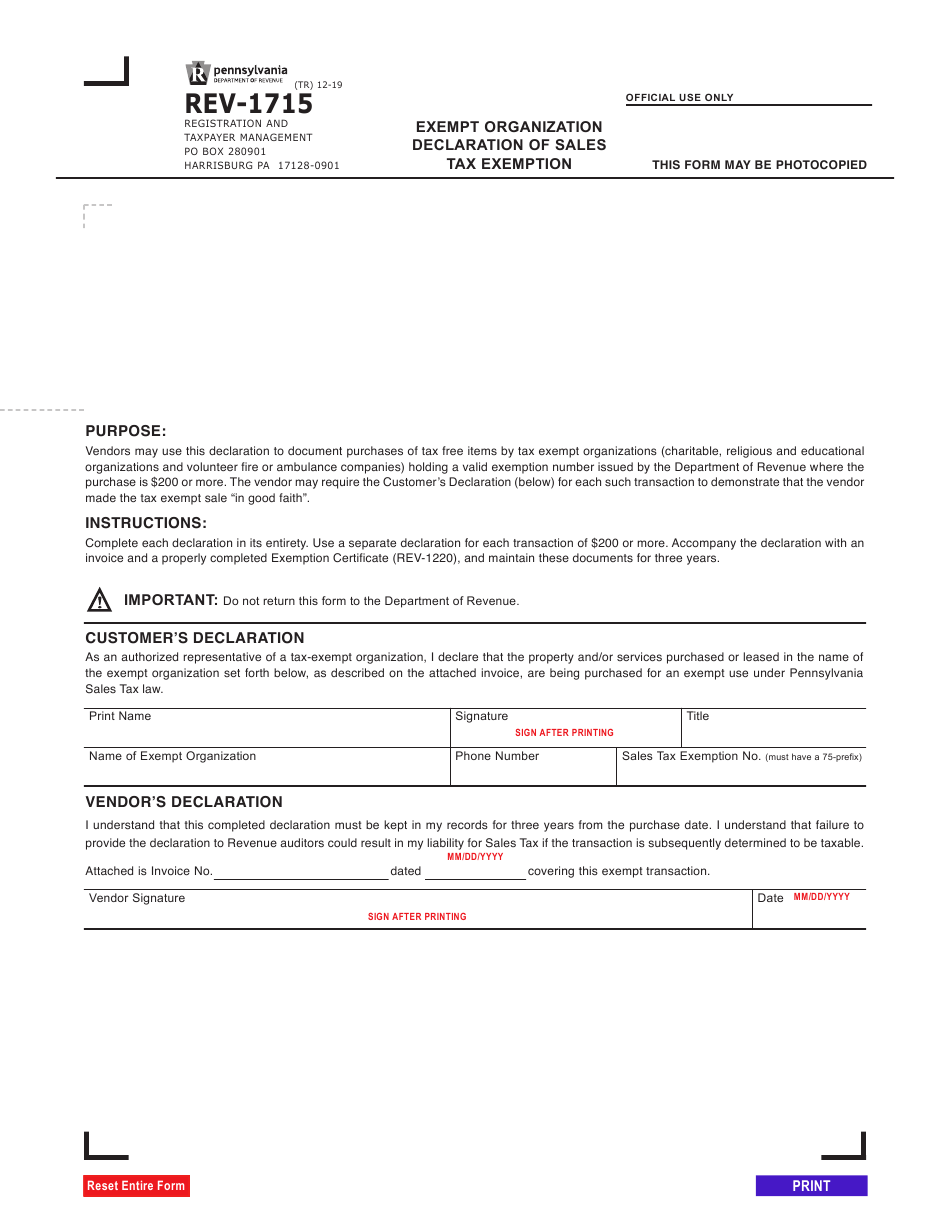

Pa Sales Taxe Exemption Form

What Is The Pennsylvania Estate Tax Exemption the pennsylvania tax applies regardless of the size of the estate. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. 15% on transfers to other heirs, except charitable organizations, exempt institutions, and government entities exempt. In general, any items the decedent owned solely, jointly or in trust are taxable unless specifically excluded from taxation by law. the pennsylvania tax applies regardless of the size of the estate. Estates and trusts are entitled to deduct from their income any. property owned jointly between spouses is exempt from inheritance tax. the family exemption is allowable against assets which are part of the decedent's probate estate. There are, however, ways to reduce pennsylvania’s inheritance tax. This means that with the right. the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. Effective for estates of decedents dying after june 30,.

From legacygroupny.com

Estate Tax Exemption Changes Coming in 2026 Estate Planning What Is The Pennsylvania Estate Tax Exemption Estates and trusts are entitled to deduct from their income any. the family exemption is allowable against assets which are part of the decedent's probate estate. Effective for estates of decedents dying after june 30,. This means that with the right. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. the. What Is The Pennsylvania Estate Tax Exemption.

From finance.gov.capital

What is the current Estate Tax exemption limit? Finance.Gov.Capital What Is The Pennsylvania Estate Tax Exemption the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. property owned jointly between spouses is exempt from inheritance tax. the pennsylvania tax applies regardless of the size of the estate. In general, any items the decedent owned solely, jointly or in trust are taxable unless specifically excluded from taxation by law.. What Is The Pennsylvania Estate Tax Exemption.

From www.formsbank.com

Form Rev1220 As Pennsylvania Exemption Certificate 2006 printable What Is The Pennsylvania Estate Tax Exemption There are, however, ways to reduce pennsylvania’s inheritance tax. Estates and trusts are entitled to deduct from their income any. the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. property owned jointly between spouses is exempt from inheritance tax. Effective for estates of decedents dying after. What Is The Pennsylvania Estate Tax Exemption.

From sdp-planning.com

A Brief History of Estate Taxes Slate Disharoon Parrish and Associates What Is The Pennsylvania Estate Tax Exemption There are, however, ways to reduce pennsylvania’s inheritance tax. the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. Effective for estates of decedents dying after june 30,. Estates and trusts are. What Is The Pennsylvania Estate Tax Exemption.

From www.dochub.com

Pennsylvania exemption certificate Fill out & sign online DocHub What Is The Pennsylvania Estate Tax Exemption Effective for estates of decedents dying after june 30,. There are, however, ways to reduce pennsylvania’s inheritance tax. the family exemption is allowable against assets which are part of the decedent's probate estate. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. property owned jointly between spouses is exempt from inheritance. What Is The Pennsylvania Estate Tax Exemption.

From www.formsbank.com

Fillable Form Rev 1220 As+ Pennsylvania Exemption Certificate What Is The Pennsylvania Estate Tax Exemption property owned jointly between spouses is exempt from inheritance tax. the family exemption is allowable against assets which are part of the decedent's probate estate. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. Estates and trusts are entitled to deduct from their income any. This means that with the right.. What Is The Pennsylvania Estate Tax Exemption.

From www.fmjlaw.com

Preview of 2023 Estate Tax Exemptions and What to do Now Fafinski What Is The Pennsylvania Estate Tax Exemption the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. This means that with the right. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. the pennsylvania tax applies regardless of the size of the estate. the family exemption. What Is The Pennsylvania Estate Tax Exemption.

From www.financialsamurai.com

Historical Estate Tax Exemption Amounts And Tax Rates What Is The Pennsylvania Estate Tax Exemption the pennsylvania tax applies regardless of the size of the estate. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. Effective for estates of decedents dying after june 30,. 15% on transfers to other heirs, except charitable organizations, exempt institutions, and government entities exempt. Estates and trusts are entitled to deduct. What Is The Pennsylvania Estate Tax Exemption.

From www.signnow.com

Pennsylvania Exemption Certificate Rev 1220 Form Fill Out and Sign What Is The Pennsylvania Estate Tax Exemption property owned jointly between spouses is exempt from inheritance tax. Estates and trusts are entitled to deduct from their income any. There are, however, ways to reduce pennsylvania’s inheritance tax. the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. the pennsylvania tax applies regardless of. What Is The Pennsylvania Estate Tax Exemption.

From www.slideserve.com

PPT ESTATE AND GIFT TAX SELECTED OVERVIEW PLUS REFORM? OR What Is The Pennsylvania Estate Tax Exemption This means that with the right. 15% on transfers to other heirs, except charitable organizations, exempt institutions, and government entities exempt. the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. Effective for estates of decedents dying after june 30,. property owned jointly between spouses is. What Is The Pennsylvania Estate Tax Exemption.

From shinyasurya.blogspot.com

pa estate tax exemption 2020 Great If LogBook Efecto What Is The Pennsylvania Estate Tax Exemption the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. There are, however, ways to reduce pennsylvania’s inheritance tax. property owned jointly between spouses is exempt from inheritance tax. This means that with the right. Estates and trusts are entitled to deduct from their income any. . What Is The Pennsylvania Estate Tax Exemption.

From www.templateroller.com

2023 City of Philadelphia, Pennsylvania Application for Exemption of What Is The Pennsylvania Estate Tax Exemption the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. Effective for estates of decedents dying after june 30,. the family exemption is allowable against assets which are part of the decedent's probate estate. the pennsylvania tax applies regardless of the size of the estate. There. What Is The Pennsylvania Estate Tax Exemption.

From www.templateroller.com

City of Philadelphia, Pennsylvania Petition Seeking a Late Nonprofit What Is The Pennsylvania Estate Tax Exemption the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. the family exemption is allowable against assets which are part of the decedent's probate estate. Estates and trusts are entitled to deduct from their income any. There are, however, ways to reduce pennsylvania’s inheritance tax. In general, any items the decedent owned solely,. What Is The Pennsylvania Estate Tax Exemption.

From goldleafestateplan.com

What Is Federal Estate Tax Exemption, and Does It Matter? Gold Leaf What Is The Pennsylvania Estate Tax Exemption There are, however, ways to reduce pennsylvania’s inheritance tax. the federal estate tax exemption is $13.61 million in 2024 and $12.92 million in 2023. This means that with the right. 15% on transfers to other heirs, except charitable organizations, exempt institutions, and government entities exempt. property owned jointly between spouses is exempt from inheritance tax. the. What Is The Pennsylvania Estate Tax Exemption.

From alterraadvisors.com

Federal Estate Tax Exemption 2022 Making the Most of History’s Largest What Is The Pennsylvania Estate Tax Exemption Estates and trusts are entitled to deduct from their income any. In general, any items the decedent owned solely, jointly or in trust are taxable unless specifically excluded from taxation by law. the pennsylvania tax applies regardless of the size of the estate. 15% on transfers to other heirs, except charitable organizations, exempt institutions, and government entities exempt.. What Is The Pennsylvania Estate Tax Exemption.

From www.dochub.com

Pennsylvania exemption certificate Fill out & sign online DocHub What Is The Pennsylvania Estate Tax Exemption the pennsylvania tax applies regardless of the size of the estate. Estates and trusts are entitled to deduct from their income any. the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. In general, any items the decedent owned solely, jointly or in trust are taxable unless. What Is The Pennsylvania Estate Tax Exemption.

From www.templateroller.com

City of Philadelphia, Pennsylvania Application for the Exemption of What Is The Pennsylvania Estate Tax Exemption property owned jointly between spouses is exempt from inheritance tax. the family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in. Effective for estates of decedents dying after june 30,. Estates and trusts are entitled to deduct from their income any. There are, however, ways to reduce pennsylvania’s. What Is The Pennsylvania Estate Tax Exemption.

From tutore.org

Pennsylvania Exemption Certificate Master of Documents What Is The Pennsylvania Estate Tax Exemption This means that with the right. 15% on transfers to other heirs, except charitable organizations, exempt institutions, and government entities exempt. property owned jointly between spouses is exempt from inheritance tax. In general, any items the decedent owned solely, jointly or in trust are taxable unless specifically excluded from taxation by law. the pennsylvania tax applies regardless. What Is The Pennsylvania Estate Tax Exemption.